Navigating the Complexities of Transfer Pricing: A Comprehensive Guide for Canada and the United States

4.3 out of 5

| Language | : | English |

| File size | : | 8063 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 257 pages |

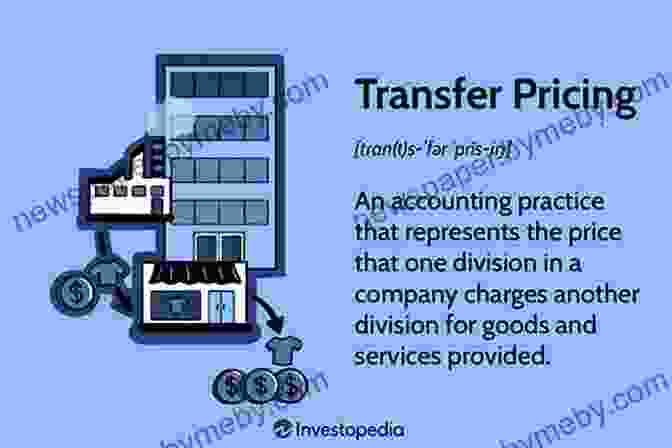

Transfer pricing, the practice of setting prices for transactions between related entities within a multinational corporation (MNC),poses unique challenges for businesses operating between Canada and the United States. This comprehensive guide offers a thorough exploration of transfer pricing principles, regulations, and best practices, arming you with the knowledge and strategies to:

- Optimize tax efficiency by ensuring appropriate transfer prices that align with arm's-length principles.

- Mitigate risks of tax audits and disputes by aligning your transfer pricing policies with the latest regulations and guidelines.

- Navigate the complexities of intercompany transactions and ensure compliance with both Canadian and US tax authorities.

Chapter 1: Understanding Transfer Pricing Principles and Regulations

This chapter lays the foundation for understanding transfer pricing, including:

- The concept of arm's-length pricing and its significance in determining fair value for intercompany transactions.

- The role of the Organisation for Economic Co-operation and Development (OECD) and its guidelines for transfer pricing.

- Key transfer pricing methods, including comparable uncontrolled price, resale price, and cost-plus methods.

Chapter 2: Canadian and US Transfer Pricing Regulations

In-depth analysis of the specific transfer pricing regulations and requirements in Canada and the United States, covering:

- The Canadian Income Tax Act and its transfer pricing rules.

- The US Internal Revenue Code Section 482 and its transfer pricing provisions.

- Similarities and differences between the two jurisdictions' transfer pricing regulations.

Chapter 3: Transfer Pricing Documentation and Compliance

Essential guidance on transfer pricing documentation requirements and best practices, including:

- The importance of maintaining comprehensive transfer pricing documentation to support your transfer pricing positions.

- The elements of a robust transfer pricing study, including economic analysis and market data.

- Strategies for managing transfer pricing audits and resolving disputes with tax authorities.

Chapter 4: Case Studies and Practical Strategies

Real-world examples and practical strategies to illustrate the application of transfer pricing principles and compliance requirements, including:

- Case studies of successful transfer pricing planning and implementation.

- Best practices for managing intercompany transactions involving intangibles, such as trademarks and patents.

- Strategies for optimizing transfer pricing for cross-bFree Download transactions between Canada and the United States.

Chapter 5: Emerging Trends and Future Considerations

Insights into emerging trends and future considerations in transfer pricing, such as:

- The impact of digitalization on transfer pricing practices.

- The role of artificial intelligence in transfer pricing analysis.

- Anticipated changes in transfer pricing regulations and guidelines.

This comprehensive guide provides a clear and practical roadmap for navigating the complexities of transfer pricing between Canada and the United States. By understanding the principles, regulations, and best practices outlined in this book, businesses can optimize their tax efficiency, mitigate risks, and ensure compliance with both Canadian and US tax authorities.

Free Download Your Copy Today

Unlock the power of knowledge and gain a competitive edge in transfer pricing. Free Download your copy of "Transfer Pricing In Canada And The United States" today and empower your business with the insights and strategies to succeed.

4.3 out of 5

| Language | : | English |

| File size | : | 8063 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 257 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia John James Santangelo Phd

John James Santangelo Phd Peggy Rathmann

Peggy Rathmann Tiki Barber

Tiki Barber Samantha Michaels

Samantha Michaels Michael Lewis

Michael Lewis Yuto Tsukuda

Yuto Tsukuda Zona Gale

Zona Gale Michael Bamberger

Michael Bamberger John Edward Fletcher

John Edward Fletcher John Matthews

John Matthews Vivian Ice

Vivian Ice John Garrard

John Garrard John J Donohue

John J Donohue Jim O Connor

Jim O Connor Joel Karsten

Joel Karsten Traci Gormley

Traci Gormley Jocko Babin

Jocko Babin Kathy Spratt

Kathy Spratt Tim Pratt

Tim Pratt John R Christopher

John R Christopher

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Jesus MitchellUnveiling the Enchanting World of "The Shadow of the Wind" and "The Cemetery...

Jesus MitchellUnveiling the Enchanting World of "The Shadow of the Wind" and "The Cemetery...

Emanuel BellSports and Fitness Notebook: The Essential Companion for Your Fitness Journey

Emanuel BellSports and Fitness Notebook: The Essential Companion for Your Fitness Journey

Fredrick CoxMastering the Art of Strategy: Uncover the Secrets of "The 33 Strategies of...

Fredrick CoxMastering the Art of Strategy: Uncover the Secrets of "The 33 Strategies of... Braden WardFollow ·14.1k

Braden WardFollow ·14.1k Ryūnosuke AkutagawaFollow ·7.4k

Ryūnosuke AkutagawaFollow ·7.4k Jacob FosterFollow ·12.7k

Jacob FosterFollow ·12.7k Cristian CoxFollow ·14k

Cristian CoxFollow ·14k Ethan MitchellFollow ·6.5k

Ethan MitchellFollow ·6.5k Noah BlairFollow ·6.2k

Noah BlairFollow ·6.2k Leo TolstoyFollow ·7k

Leo TolstoyFollow ·7k Ivan TurgenevFollow ·8.1k

Ivan TurgenevFollow ·8.1k

Jermaine Powell

Jermaine PowellThe Ultimate Guide to Unlocking Consistent Profitable...

Introducing the 2nd Edition of the...

Yasunari Kawabata

Yasunari KawabataMinute Microskills Videos: The Ultimate Guide for Visual...

Unlock Your Potential with Bite-Sized Video...

Nathan Reed

Nathan ReedUnveiling the Wonders of Yosemite through John Muir's...

Immerse yourself in the breathtaking beauty...

Gabriel Garcia Marquez

Gabriel Garcia MarquezWhen You Find Me Novel: A Gripping Mystery Unravels

In the sleepy...

Esteban Cox

Esteban CoxMountains of California: An Essential History of...

From the towering...

Devin Ross

Devin RossComm Check: Unveiling the Heartbreaking Final Flight of...

Comm Check: The Final Flight of Shuttle...

4.3 out of 5

| Language | : | English |

| File size | : | 8063 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 257 pages |