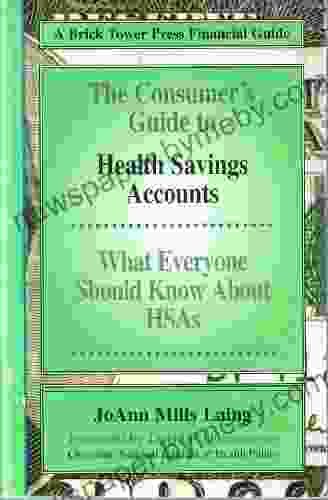

The Consumer Guide to Health Savings Accounts: Unlocking a World of Financial Freedom and Healthcare Control

: Navigating the Complexities of Healthcare Finances

In the labyrinthine world of healthcare, navigating the financial complexities can be daunting. The rising costs of medical expenses place a significant burden on individuals and families, making it crucial to explore innovative and cost-effective solutions. Health Savings Accounts (HSAs) emerge as a beacon of hope, empowering consumers with unprecedented control over their healthcare expenses.

4.5 out of 5

| Language | : | English |

| File size | : | 564 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 180 pages |

| Lending | : | Enabled |

What is a Health Savings Account (HSA)?

An HSA is a tax-advantaged savings account designed specifically for healthcare expenses. Contributions made to an HSA are tax-deductible, and withdrawals for qualified medical expenses are tax-free. HSAs are typically paired with high-deductible health plans (HDHPs),which offer lower monthly premiums but higher deductibles.

Benefits of Health Savings Accounts

HSAs offer a myriad of benefits that can transform your healthcare financial landscape:

- Tax Savings: Contributions to HSAs are tax-deductible, reducing your taxable income and potentially saving you money on taxes.

- Tax-Free Withdrawals: Withdrawals from HSAs for qualified medical expenses are tax-free, ensuring that your healthcare dollars go further.

- Investment Opportunities: HSAs can be invested to grow your savings over time, providing a supplemental source of funds for future medical expenses.

- Healthcare Control: HSAs empower you to make informed decisions about your healthcare expenses, allowing you to choose the providers and treatments that best meet your needs.

Who is Eligible for a Health Savings Account?

To be eligible for an HSA, you must meet the following criteria:

- Be enrolled in a high-deductible health plan (HDHP)

- Not have other health coverage

- Not be claimed as a dependent on someone else's tax return

Choosing the Right Health Savings Account

Selecting the right HSA is essential to maximize its benefits. Considerations include:

- Fees: Compare the fees associated with不同HSAs, such as monthly maintenance fees, investment fees, and withdrawal fees.

- Investment Options: Explore the investment options offered by different HSAs and choose one that aligns with your risk tolerance and financial goals.

- Customer Service: Opt for an HSA provider with responsive customer service to ensure prompt assistance when needed.

How to Use a Health Savings Account

Utilizing an HSA effectively requires planning and discipline:

- Contribute Regularly: Make regular contributions to your HSA to build your savings over time.

- Pay for Qualified Expenses: Use your HSA funds to cover qualified medical expenses, such as doctor's visits, prescriptions, and dental work.

- Keep Receipts: Maintain detailed receipts for all HSA-related expenses to document your withdrawals.

- Avoid Non-Qualified Expenses: Withdrawals for non-qualified expenses are subject to taxes and penalties.

Long-Term Benefits of Health Savings Accounts

HSAs not only provide immediate financial relief but also offer long-term benefits:

- Healthcare Savings: HSAs accumulate savings over time, reducing your reliance on out-of-pocket expenses in the future.

- Retirement Planning: After reaching age 65, HSAs can be used to cover non-medical expenses, providing a supplemental source of retirement income.

- Inheritance: HSAs can be passed on to beneficiaries tax-free, creating a legacy of financial security.

: Empowering Consumers with Health Savings Accounts

Health Savings Accounts (HSAs) are a powerful tool that can revolutionize the way you manage your healthcare expenses. By leveraging the tax-advantaged benefits and investment opportunities of HSAs, you gain greater control over your healthcare decisions and financial future. Embark on the journey towards financial freedom and healthcare empowerment with HSAs, the ultimate guide to unlocking a world of possibilities.

4.5 out of 5

| Language | : | English |

| File size | : | 564 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 180 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia John Mordechai Gottman

John Mordechai Gottman Joel Selvin

Joel Selvin Robin Suerig Holleran

Robin Suerig Holleran Karrine Steffans

Karrine Steffans Joann Bassett

Joann Bassett Jodi Kantor

Jodi Kantor Joe R Lansdale

Joe R Lansdale Joe Meno

Joe Meno John Mcpherson

John Mcpherson Marilyn Jansen

Marilyn Jansen Joe Shuber

Joe Shuber Joanna Gaines

Joanna Gaines Nancy L Silk

Nancy L Silk Joelle M Reizes

Joelle M Reizes Joanne Schwartz

Joanne Schwartz John D Currid

John D Currid Jim Palmer

Jim Palmer Michael Arndt

Michael Arndt John Diary

John Diary John H Groberg

John H Groberg

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Brennan BlairMerlin and the Brothers Three: A spellbinding adventure that will transport...

Brennan BlairMerlin and the Brothers Three: A spellbinding adventure that will transport...

Robert HeinleinEmbark on a Literary Journey with "Hey Black Child" by Useni Eugene Perkins

Robert HeinleinEmbark on a Literary Journey with "Hey Black Child" by Useni Eugene Perkins Pat MitchellFollow ·5.3k

Pat MitchellFollow ·5.3k Isaiah PriceFollow ·18.2k

Isaiah PriceFollow ·18.2k Ignacio HayesFollow ·19.1k

Ignacio HayesFollow ·19.1k Stanley BellFollow ·10k

Stanley BellFollow ·10k Jeffery BellFollow ·11.3k

Jeffery BellFollow ·11.3k Stephen FosterFollow ·8.6k

Stephen FosterFollow ·8.6k Rodney ParkerFollow ·7.5k

Rodney ParkerFollow ·7.5k Oliver FosterFollow ·10.5k

Oliver FosterFollow ·10.5k

Jermaine Powell

Jermaine PowellThe Ultimate Guide to Unlocking Consistent Profitable...

Introducing the 2nd Edition of the...

Yasunari Kawabata

Yasunari KawabataMinute Microskills Videos: The Ultimate Guide for Visual...

Unlock Your Potential with Bite-Sized Video...

Nathan Reed

Nathan ReedUnveiling the Wonders of Yosemite through John Muir's...

Immerse yourself in the breathtaking beauty...

Gabriel Garcia Marquez

Gabriel Garcia MarquezWhen You Find Me Novel: A Gripping Mystery Unravels

In the sleepy...

Esteban Cox

Esteban CoxMountains of California: An Essential History of...

From the towering...

Devin Ross

Devin RossComm Check: Unveiling the Heartbreaking Final Flight of...

Comm Check: The Final Flight of Shuttle...

4.5 out of 5

| Language | : | English |

| File size | : | 564 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 180 pages |

| Lending | : | Enabled |