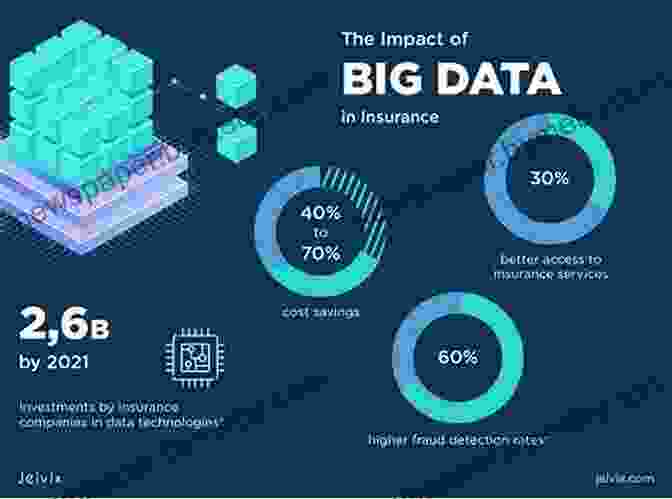

Insurance vs. Insurtech: An Evolutionary Map

The insurance industry, with its long-standing history of managing risk and providing financial protection, is undergoing a profound transformation driven by advancements in technology. The emergence of insurtech, a fusion of insurance and technology, is challenging traditional insurance practices and creating new opportunities.

5 out of 5

| Language | : | English |

| File size | : | 2487 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Print length | : | 107 pages |

| Lending | : | Enabled |

Traditional Insurance: A Foundation of Stability

Traditional insurance has been the cornerstone of risk management for centuries. It operates on the principle of risk pooling, where individuals share their risks with a larger group, and the resulting premiums are used to pay for claims. This approach has provided stability and peace of mind to policyholders.

Traditional insurance companies have well-established processes and extensive underwriting expertise. They rely on historical data and actuarial analysis to assess risks and set premiums. However, the industry has faced challenges in adapting to changing customer demands and the rapid pace of technological advancements.

Insurtech: A Catalyst for Innovation

Insurtech, a relatively new industry, is leveraging technology to disrupt traditional insurance models. Insurtech companies utilize advanced analytics, machine learning, and digital platforms to offer personalized and tailored insurance solutions.

Insurtech startups are bringing agility and innovation to the insurance sector. They are developing new products, streamlining processes, and creating entirely new ways of interacting with customers. Insurtech has the potential to enhance risk assessment, improve claims handling efficiency, and reduce costs.

Evolutionary Milestones

The evolution of insurance towards insurtech has been marked by several key milestones:

- Data Analytics and Machine Learning: Insurtech companies use advanced analytics and machine learning algorithms to gather and analyze vast amounts of data. This enables them to better understand risks, predict claims, and personalize premiums.

- Digital Platforms and Mobile Apps: Insurtech has embraced digital platforms and mobile apps, making it easier for customers to access insurance products and services. They offer convenient and user-friendly interfaces, allowing customers to compare quotes, Free Download policies, and file claims online.

- On-Demand Insurance: Insurtech has introduced the concept of on-demand insurance, where customers can Free Download temporary coverage for specific activities or events. This flexibility is particularly appealing to customers who do not require long-term insurance policies.

- Artificial Intelligence (AI) for Underwriting: AI is revolutionizing underwriting by automating risk assessment and claims processing. Insurtech companies use AI to analyze large volumes of data, including social media profiles and driving habits, to assess risks more accurately and fairly.

Challenges and Opportunities

While insurtech offers immense potential, it also presents challenges and opportunities for traditional insurance companies:

- Adapting to Disruption: Traditional insurance companies face the challenge of adapting to the rapidly changing landscape brought about by insurtech. They must embrace innovation and invest in technology to remain competitive.

- Cybersecurity and Data Privacy: The use of advanced analytics and digital platforms by insurtech companies raises concerns about cybersecurity and data privacy. Insurers must implement robust security measures to protect customer information.

- Collaboration and Partnerships: Rather than viewing insurtech as a threat, traditional insurance companies can explore strategic partnerships with insurtech startups to leverage their technological capabilities and reach new customer segments.

- Evolving Regulatory Landscape: The regulatory landscape is evolving in response to the growth of insurtech. Regulators are working to provide clear guidelines and ensure fair competition while protecting consumer interests.

The Future of Insurance

The future of insurance lies in the convergence of traditional insurance and insurtech. Insurers who embrace innovation and collaborate with insurtech startups will be best positioned to succeed.

We can expect to see further advancements in technology, such as the use of blockchain for secure record-keeping and the development of parametric insurance for more efficient claims handling. The industry will also continue to focus on customer-centric solutions, personalization, and the seamless integration of technology into insurance products and services.

The evolutionary journey of insurance towards insurtech is a testament to the industry's ability to adapt and innovate. Traditional insurance companies and insurtech startups are playing complementary roles in shaping the future of risk management and financial protection.

As the insurance industry continues to evolve, we can anticipate continued innovation, enhanced customer experiences, and a more efficient and resilient risk management system for the benefit of all stakeholders.

5 out of 5

| Language | : | English |

| File size | : | 2487 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Print length | : | 107 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Vibrant Publishers

Vibrant Publishers John D French

John D French Joan Jacobs Brumberg

Joan Jacobs Brumberg Peggy Rathmann

Peggy Rathmann Wendy Holden

Wendy Holden Yassine Janane

Yassine Janane Lawrence C Vetter

Lawrence C Vetter Joanne Simon Walters

Joanne Simon Walters Vicky Young

Vicky Young Michael L Henderson

Michael L Henderson John Geraci

John Geraci Len Goodman

Len Goodman John G Miller

John G Miller Jon B Gould

Jon B Gould Joel Hooks

Joel Hooks Jim Shumway

Jim Shumway John Badham

John Badham John Bul Dau

John Bul Dau John Bowman

John Bowman Nina Ida Marie Spadaro Edd

Nina Ida Marie Spadaro Edd

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Richard AdamsUnlock the Enchanting World of "The French Billionaires Token": A Billionaire...

Richard AdamsUnlock the Enchanting World of "The French Billionaires Token": A Billionaire... Casey BellFollow ·16.2k

Casey BellFollow ·16.2k Jamal BlairFollow ·4.3k

Jamal BlairFollow ·4.3k William GoldingFollow ·10.6k

William GoldingFollow ·10.6k Leo TolstoyFollow ·7k

Leo TolstoyFollow ·7k Cormac McCarthyFollow ·11.3k

Cormac McCarthyFollow ·11.3k Jamie BellFollow ·14.1k

Jamie BellFollow ·14.1k Terry PratchettFollow ·9.9k

Terry PratchettFollow ·9.9k Ernest PowellFollow ·16.9k

Ernest PowellFollow ·16.9k

Jermaine Powell

Jermaine PowellThe Ultimate Guide to Unlocking Consistent Profitable...

Introducing the 2nd Edition of the...

Yasunari Kawabata

Yasunari KawabataMinute Microskills Videos: The Ultimate Guide for Visual...

Unlock Your Potential with Bite-Sized Video...

Nathan Reed

Nathan ReedUnveiling the Wonders of Yosemite through John Muir's...

Immerse yourself in the breathtaking beauty...

Gabriel Garcia Marquez

Gabriel Garcia MarquezWhen You Find Me Novel: A Gripping Mystery Unravels

In the sleepy...

Esteban Cox

Esteban CoxMountains of California: An Essential History of...

From the towering...

Devin Ross

Devin RossComm Check: Unveiling the Heartbreaking Final Flight of...

Comm Check: The Final Flight of Shuttle...

5 out of 5

| Language | : | English |

| File size | : | 2487 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Print length | : | 107 pages |

| Lending | : | Enabled |