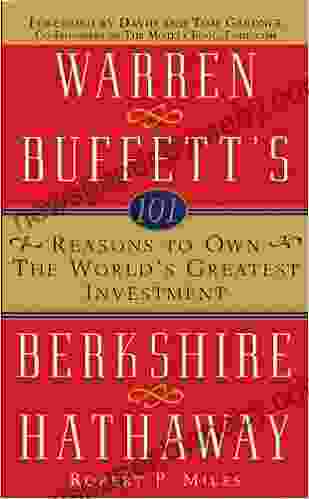

Warren Buffett: The Master Investor of Berkshire Hathaway

Warren Buffett is one of the most successful investors of all time. He is the CEO of Berkshire Hathaway, a conglomerate that owns dozens of companies, including insurance, energy, and manufacturing businesses. Buffett has a net worth of over $100 billion, and he is known for his value investing philosophy.

4.1 out of 5

| Language | : | English |

| File size | : | 2193 KB |

| Text-to-Speech | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 272 pages |

| Lending | : | Enabled |

Buffett was born in Omaha, Nebraska, in 1930. He began investing at a young age, and he bought his first stock at the age of 11. Buffett graduated from Columbia University in 1951, and he then went to work for Benjamin Graham, the father of value investing. Buffett learned Graham's value investing principles, and he has used them to great success throughout his career.

In 1965, Buffett took control of Berkshire Hathaway, a struggling textile company. He began to turn the company around by investing in undervalued businesses. Over time, Berkshire Hathaway has grown into one of the largest and most successful companies in the world.

Buffett is a long-term investor. He believes in buying stocks of companies that he believes are undervalued and holding them for the long term. Buffett is also a patient investor. He is willing to wait for his investments to appreciate in value, and he does not panic when the market goes down.

Buffett's investing philosophy has been very successful. He has consistently outperformed the market over the long term. Buffett is a role model for many investors, and his writings on investing are widely read.

Buffett's Investing Strategies

Buffett's investing strategies are based on the principles of value investing. Value investing is a style of investing that involves buying stocks of companies that are trading at a discount to their intrinsic value. Buffett believes that these stocks are undervalued by the market, and he is willing to buy them at a discount and hold them for the long term.

Buffett looks for companies that have the following characteristics:

- A strong competitive advantage

- A consistent earnings record

- A low debt-to-equity ratio

- A management team that is aligned with the interests of shareholders

Buffett is also willing to buy companies that are out of favor with the market. These companies may be experiencing temporary setbacks, but Buffett believes that they have the potential to recover and become valuable investments.

Buffett is a patient investor. He is willing to wait for his investments to appreciate in value, and he does not panic when the market goes down. Buffett believes that the stock market is a voting machine in the short term, but a weighing machine in the long term. He is confident that his investments will eventually be worth more than he paid for them.

Buffett's Life and Career

Warren Buffett was born in Omaha, Nebraska, in 1930. He began investing at a young age, and he bought his first stock at the age of 11. Buffett graduated from Columbia University in 1951, and he then went to work for Benjamin Graham, the father of value investing. Buffett learned Graham's value investing principles, and he has used them to great success throughout his career.

In 1965, Buffett took control of Berkshire Hathaway, a struggling textile company. He began to turn the company around by investing in undervalued businesses. Over time, Berkshire Hathaway has grown into one of the largest and most successful companies in the world.

Buffett is a long-term investor. He believes in buying stocks of companies that he believes are undervalued and holding them for the long term. Buffett is also a patient investor. He is willing to wait for his investments to appreciate in value, and he does not panic when the market goes down.

Buffett's investing philosophy has been very successful. He has consistently outperformed the market over the long term. Buffett is a role model for many investors, and his writings on investing are widely read.

Warren Buffett is one of the most successful investors of all time. His investing strategies are based on the principles of value investing, and he has consistently

4.1 out of 5

| Language | : | English |

| File size | : | 2193 KB |

| Text-to-Speech | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 272 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Nicholas Kardaras

Nicholas Kardaras Lore Cottone

Lore Cottone Jim Hynes

Jim Hynes Susan Edsall

Susan Edsall Jiri Kolaja

Jiri Kolaja Sarah Zettel

Sarah Zettel Julia L Foulkes

Julia L Foulkes Jim Grimsley

Jim Grimsley Joanne Mattern

Joanne Mattern Nigel Vaz

Nigel Vaz Nina Ida Marie Spadaro Edd

Nina Ida Marie Spadaro Edd Joe Tasker

Joe Tasker John Boyko

John Boyko John Bul Dau

John Bul Dau John J Ratey

John J Ratey Susan H Kamei

Susan H Kamei Marianne Hering

Marianne Hering Mark Bertrang

Mark Bertrang Robert Staffanson

Robert Staffanson Mitchell S Jackson

Mitchell S Jackson

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Ryan FosterTrue Stories From Sharm El Sheikh Scuba Diving Instructor: Dive into a World...

Ryan FosterTrue Stories From Sharm El Sheikh Scuba Diving Instructor: Dive into a World...

Jared NelsonMemoirs of Bengal Civilian: A Timeless Classic Unveiling the Enchanting World...

Jared NelsonMemoirs of Bengal Civilian: A Timeless Classic Unveiling the Enchanting World... Austin FordFollow ·4.6k

Austin FordFollow ·4.6k Kurt VonnegutFollow ·7.3k

Kurt VonnegutFollow ·7.3k Milton BellFollow ·17.3k

Milton BellFollow ·17.3k Anthony WellsFollow ·16.9k

Anthony WellsFollow ·16.9k Bryan GrayFollow ·17.8k

Bryan GrayFollow ·17.8k Jack PowellFollow ·13.8k

Jack PowellFollow ·13.8k Jeffrey CoxFollow ·18.1k

Jeffrey CoxFollow ·18.1k Paul ReedFollow ·13k

Paul ReedFollow ·13k

Jermaine Powell

Jermaine PowellThe Ultimate Guide to Unlocking Consistent Profitable...

Introducing the 2nd Edition of the...

Yasunari Kawabata

Yasunari KawabataMinute Microskills Videos: The Ultimate Guide for Visual...

Unlock Your Potential with Bite-Sized Video...

Nathan Reed

Nathan ReedUnveiling the Wonders of Yosemite through John Muir's...

Immerse yourself in the breathtaking beauty...

Gabriel Garcia Marquez

Gabriel Garcia MarquezWhen You Find Me Novel: A Gripping Mystery Unravels

In the sleepy...

Esteban Cox

Esteban CoxMountains of California: An Essential History of...

From the towering...

Devin Ross

Devin RossComm Check: Unveiling the Heartbreaking Final Flight of...

Comm Check: The Final Flight of Shuttle...

4.1 out of 5

| Language | : | English |

| File size | : | 2193 KB |

| Text-to-Speech | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 272 pages |

| Lending | : | Enabled |